Kuala Lumpur, Malaysia – PayMate, a digital B2B payments firm, has recently introduced a business payments app designed to empower small and medium enterprises in optimising working capital and driving long-term growth.

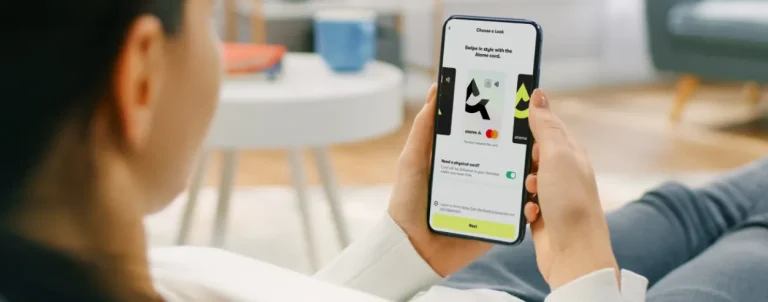

This new application offers a user-friendly platform to handle B2B payments, including suppliers who do not typically accept card payments. With this, business owners can now use both commercial and retail credit cards to pay suppliers, rent, and contractors, significantly enhancing efficiency across operations.

It also expands credit card usage beyond traditional expanses, enabling a broader range of B2B payments and a new level of flexibility to the way SMEs manage their payments and finances. This approach provides up to 55 days of interest-free credit on existing cards.

Built on a PCI DSS-certified platform, the PayMate app further ensures advanced security for all transactions, empowering businesses with the tools they need to drive expansion and financial stability.

Meanwhile, its easy-to-use interface and enhanced cash flow management features support SMEs to plan and allocate resources more efficiently, allowing them to make payments quickly, seize growth opportunities, and maintain operational agility.

Rakesh Khanna, chief commercial officer at PayMate, said, “We are proud to launch our new business payments app in Malaysia, which is thoughtfully designed to meet the needs of SMEs by offering features that enhance working capital optimisation and streamline B2B payments.”

“Recognising Malaysia as a vital market, we are committed to supporting its SMEs on their growth journey with innovative, secure, and reliable payment solutions that enable them to thrive in an increasingly digital landscape,” he added.

Meanwhile, Amirreza Sawal, general manager at PayMate Asia Pacific, commented, “At PayMate, we recognise the ongoing challenges faced by Malaysian SMEs in managing their cash flow. Traditional financial processes can be manual and time-consuming, often hindering business growth.”

“Our new Business Payments App addresses these by optimising working capital and streamlining B2B payments, empowering businesses to take full control of their finances. With features such as unlimited transfers and the flexibility to make payments via credit cards, SMEs can seize opportunities and manage their supplier payments with greater agility,” Sawal further explained.

The launch commemorates PayMate’s recent collaboration with the Selangor Information Technology & Digital Economy Corporation (SIDEC), which has been actively driving SME development in Malaysia. Said move aligns with SIDEC’s commitment to digital transformation, equipping SMEs with solutions to thrive in the current digital economy.

Given the app enhances working capital management and simplifies payment workflows, this initiative reinforces SIDEC’s goal of fostering innovation, improving SME financial health, and advancing local economic development.

The new application was unveiled at the recently concluded Selangor Smart City & Digital Economy Conference (SDEC) 2024 and was officiated by the Chief Minister of Selangor, YAB Dato’ Seri Amirudin Shari, alongside Selangor State Exco, YB Tuan Mohd Najwan Halimi.