Sydney, Australia – Nium, a global cross-border payments firm, has recently announced the company’s threefold increase in monthly payment volume over the past year within the Oceania region.

According to the firm, the expansion is attributed to increasing adoption from financial institutions and spend management platforms, with AI-powered platform RedOwl becoming Nium’s newest partner.

Said collaboration brings AI into payment rails, championing intelligence and real-time decision-making for card-related payments.

Additionally, the company’s success in Australia is further strengthened by a significant milestone in New Zealand, where it has registered as a financial service provider.

This development signifies the company’s entry into the evolving financial landscape of the country, allowing it to offer a range of financial solutions to local businesses.

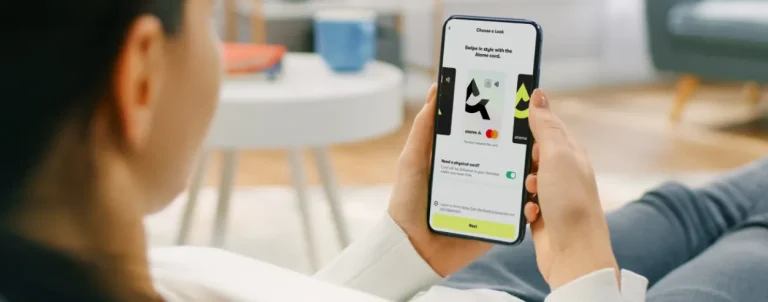

The firm anticipates its offerings to range from virtual accounts and global payouts to debit and prepaid cards, allowing businesses to simplify operations and improve their financial efficiency.

Jitto Arulampalam, co-founder and CEO at RedOwl, said, “We chose Nium because of their unparalleled infrastructure and expertise in powering modern payments. Their solutions allow us to enter the market faster and deliver greater value to our customers.”

Anupam Pahuja, EVP and GM for APAC, Middle East, and Africa at Nium, also shared, “The spend management industry is booming in Australia, with businesses increasingly turning to Nium for its white-label card issuing and cross-border payment solutions.”

He further added, “Our platform solves complex payment problems across a wide range of verticals, including travel, payroll, insurance, and e-commerce. Our card issuance solution has already issued over 75 million cards globally, supporting major global brands. This, along with Nium’s extensive geographical coverage and B2B infrastructure focus, positions the company as a critical enabler for businesses looking to scale in Australia, New Zealand, and beyond.”

“Becoming a registered financial service provider in New Zealand reaffirms our commitment to delivering innovative financial solutions globally. Our presence in New Zealand, alongside our established operations in Australia, positions us as a key player in the region’s financial ecosystem, empowering businesses to thrive through our technology,” concluded Pahuja.