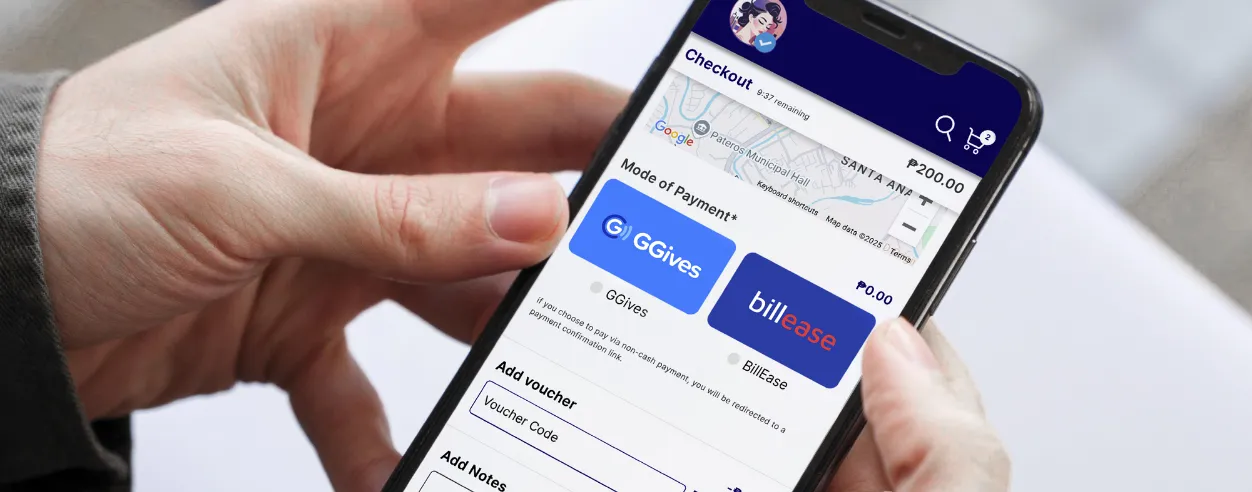

Philippines – Enstack, an all-in-one AI-powered store builder for entrepreneurs, has recently announced the integration of GGives and BillEase into its platform, expanding payment flexibility with Buy Now, Pay Later (BNPL) options.

With this initiative, the company aims to enable Enstack merchants to offer buyers instalment plans of up to 24 months through GCash’s GGives and BillEase, improving credit accessibility and boosting sales.

Furthermore, it also allows sellers to offer BNPL without financial risk, upfront costs, or complicated setup. Said partnership democratises BNPL access, helping small businesses to compete with larger e-commerce players.

According to the firm, GGives is also exclusively accessible to qualified Enstack merchants. This move allows them to offer instalment plans through GCash’s trusted payment network. Similarly, Entack’s integration of BillEase empowers sellers with more payment solutions, helping them attract and retain more customers.

Commenting about this initiative, Macy Castillo, CEO and co-founder at Enstack, said, “Giving merchants access to instalment payments is a game-changer for their business. By enabling merchants to offer trusted Pay Later solutions, we’re helping them expand their customer base – including those who may not have the cash upfront but are willing to pay in instalments.”

“At Enstack, we make it easier for merchants to grow by offering seamless, AI-powered business solutions. With BNPL, they can increase their average order value, attract budget-conscious buyers, and build stronger customer relationships—all within the Enstack ecosystem,” added Castillo.