Singapore – Banking across global markets is rapidly evolving with legacy systems being replaced by secure, integrated, and seamless next-generation frameworks.

This is highly prevalent in the APAC region, with banks and financial institutions constantly searching for ways to streamline transactions across borders, amidst fragmented regulations.

Open banking and open finance are providing gateways to connect the diverse markets across the region, enhancing both back-end and front-end experience journeys.

Speaking with UpTech Media, Todd D Schweitzer, founder and CEO of Brankas, explained what open banking and open finance mean for their company and how it is reshaping the financial landscape in the region.

“Open finance is the commercial evolution of open banking that expands data sharing beyond payment accounts to include broader sectors like insurance, investments, and lending, often utilising non-mandated premium APIs,” Todd told UpTech Media.

Customers expect modern day finance in the digital age to be secure and streamlined when completing transactions. Open banking allows this by enabling customers and businesses to control their financial data and who it is shared with through standardised APIs. Meanwhile, Open finance helps fintechs and banks manage this data through integrated and secure frameworks.

“In short, Open banking is the regulatory foundation that gives customers control over payment data, while Open finance is the commercial expansion that allows institutions to monetise connectivity across the entire financial spectrum through services and partnerships,” he shared.

Digital nervous system of modern finance

Today, digital payments are seamlessly integrated into a wide range of online platforms, connecting nonbank businesses to banking services and financial institutions. One click of the checkout button provides customers with quick access to their nominated banks or e-wallets to execute a swift purchase.

This is all made possible through standardised and regulated APIs. At Brankas, APIs serve as the digital nervous system of modern financial systems, ensuring standardised connectivity for structured data paths, consent management providing secure gateways, and real-time interoperability for instant transactions.

Todd highlighted that Banking-as-a-Service (BaaS) and ecosystem banking are redefining how banks operate in the digital era. He shared how the BaaS market size was valued at US$18.6b in 2024 and is projected to grow between 2025 and 2034.

“By allowing nonbank businesses to provide banking services, banks now act as platforms to provide regulated infrastructure, core banking functions, compliance safeguards, and risk management while enabling third parties like fintechs, marketplaces, and super apps to embed financial services directly into their customer applications,” he explained.

In the Philippines, customers from GCash, one of the leading e-wallets in the country, also opened new accounts with CIMB PH, leading to an 80% increase in account openings, along with UNOBank seeing a 50%, which resulted in hypergrowth for both banking institutions.

The seamless integration and security of financial data from both banks on GCash provided Filipino customers with more flexibility in managing their finances, replacing the need to visit physical banks with just a few taps on the screen.

“In this era, consumers expect seamless, secure, and personalised financial experiences, from onboarding and payments to cash-flow management and credit, delivered consistently across platforms and touchpoints,” Todd shared.

He added that establishing digital ecosystems is no longer optional for financial institutions; it has become a competitive and strategic imperative. For this to happen, APIs must be seen as the connective tissue of modern financial systems to scale efficiently, adapt quickly, and integrate securely with partners across industries.

“Much like roads in the physical economy, APIs do not simply transport value but actively enable economic activity itself. As open finance continues to mature, APIs will only grow in strategic importance.” Todd stated.

Roadmap to accessible banking for all

Brankas was one of the initial forerunners to globalise open banking and open finance across key markets, especially in Southeast Asia.

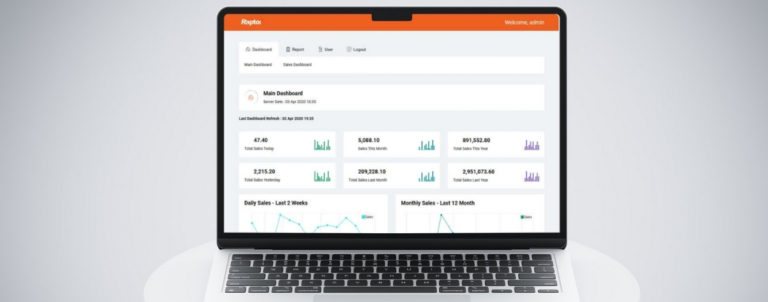

Currently, the company offers the Brankas Open Finance Suite (OFS) as the core solution and comprehensive platform designed to support banks in expanding capabilities in the modern age of banking.

“The Brankas OFS is a specialised niche solution that integrates seamlessly into any banking infrastructure,” Todd shared.

He added, “Built to operate on top of existing API gateway platforms or core ganking solutions, as the need be, it is designed for broad product capabilities, modular components, ease of integration, and strong emphasis on security and user experience.”

From observation, Todd explained that most banks and financial institutions still view open finance as a regulation checklist rather than a strategic avenue for commercial purposes. It is still viewed as risky and overshadowed by uncertainty.

However, in developing countries across APAC, more banks are inclined to adopt open banking and open finance, with regulations already implemented by central banks in parallel with the boom of BaaS markets in the region.

“By simplifying access to essential financial services, we help bridge the gap for underserved customers and empower SMEs and mass-market consumers to participate in the digital economy,” Todd commented.

He further explained, “This includes expanding access to embedded finance and embedded lending, allowing consumers and businesses to access credit and financial services directly within the platforms they already use.”

APIs play a significant role in supporting banks and financial institutions to embrace open banking and open finance and utilise digital platforms to deploy, scale and monetise.

Todd highlighted that modern finance is about bridging technology, regulation, and commercial opportunities to help customers move beyond experimentation and transform open finance into scalable, revenue-generating business models.

It is reshaping how banks and financial institutions operate in the digital age and changing the definition of what banking means to customers across APAC and global markets.

“In the long term, open finance serves beyond a technology shift. It represents a more inclusive, competitive, and consumer-centric financial system,” Todd concluded.

*******

Activating transactions has never been easier than before. Banks and financial institutions are taking steps forward to deliver more connected, secure, and inclusive financial solutions for customers across global markets through open banking, open finance, and APIs.

Brankas continues to pave the way into the future of banking across the APAC region and key global markets, providing greater accessibility to open banking and open finance to all.