Singapore – Adyen has entered into a collaboration with Raptor to integrate payment capabilities into Raptor’s POS solutions for service and hospitality operators in Singapore. Raptor has been providing POS systems to more than 7,000 businesses across the APAC region since its establishment in 2001, with a strong focus on small and medium-sized enterprises.

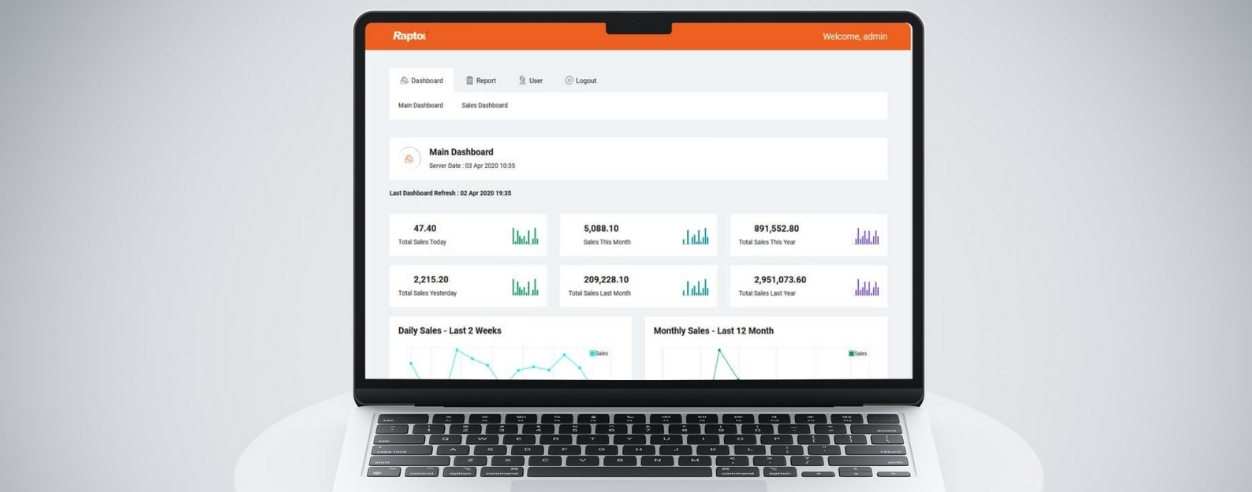

Through the use of Adyen for platforms, Raptor has incorporated payment functionality directly into its software, enabling merchants to manage transactions within a single system. Integrated payments have become an increasing operational requirement for SMBs, particularly as multi-channel reconciliation remains a challenge.

Research conducted by YouGov on behalf of Adyen indicates that 75% of surveyed SMBs in Singapore identify cross-channel payment reconciliation as a significant operational difficulty.

“Collaborating with Raptor allows us to bring our payments innovation to a broader spectrum of businesses across the region,” Ben Wong, general manager of Southeast Asia and Hong Kong at Adyen, commented.

“Additionally, when traditional service providers evolve into fintechs, they do more than just retain their platform users; they fuel a more resilient and scalable merchant ecosystem.”

By embedding payments into its POS offering, Raptor enables its users to access unified transaction reporting across different sales channels. This provides businesses with a consolidated overview of customer activity, including purchasing behaviour and preferred payment options, supporting more informed operational and financial decision-making.

“Partnering with Adyen allows us to bridge the gap between operations and finance, providing SMBs with a unified platform that doesn’t just support their business – it accelerates it,” Leslie Tan, founder of Raptor, shared.

The integrated payments capability is being adopted by Natureland, a Singapore-based wellness and massage provider with 15 outlets nationwide. The company plans to introduce an online booking platform in 2026 that will allow customers to reserve appointments using deposits paid through a range of domestic and international payment methods supported by Adyen.

“Digitalisation is a key focus for us as we continue to evolve our operations,” Fion Wu, managing director of Natureland, commented.

“Strengthening our payment capabilities is part of this focus, as it enables us to offer customers a secure and smooth payment experience across our outlets.”

The partnership between Adyen and Raptor is positioned to address this demand by combining operational software with embedded financial services, supporting digital transformation efforts within the service sector and contributing to a more scalable merchant environment in Singapore.