Manila, Philippines – GoTyme Bank has announced a strategic partnership with Wise Platform, a global provider of payment infrastructure for financial institutions and enterprises.

The collaboration makes GoTyme Bank the first partner bank of Wise Platform in the Philippines, and its initial international receiving partner in the APAC region. The initiative aims to provide more than 7.8 million Filipino customers with faster, lower-cost, and more transparent options for receiving international remittances through the GoTyme Bank app.

The partnership addresses long-standing challenges faced by OFW and their families, including high transfer charges, hidden fees, lengthy transaction times, and limited visibility over remittance processes.

“Our collaboration with Wise is about creating a trusted remittance experience that feels effortless,” Nate Clarke, President and CEO of GoTyme Bank, commented.

He added, “By pairing Wise’s world-class technology and global network with GoTyme Bank’s simple, beautiful banking, we’re redefining how Filipinos support their families, grow their ambitions, and stay connected to what matters most.”

Through the integration with Wise Platform, GoTyme Bank enables users to receive international payments quickly and easily over SWIFT. Customers can now receive funds from over 11,000 banks across the world in 23 key currencies—including USD, EUR, GBP, AUD, and SGD—benefiting from greater pricing transparency and shorter settlement periods.

“As the first Wise Platform partnership in the Philippines, it demonstrates how we’re extending beyond our own products to power better financial services through partners,” Samarth Bansal, APAC General Manager of Wise Platform, stated.

He added, “For 14 years, Wise has been building the best infrastructure in moving money across borders, and it’s exciting to see our partner banks benefit from this infrastructure through Wise Platform.”

Remittances remain a cornerstone of the Philippine economy, with OFWs sending over US$38b annually—one of the largest inflows globally and a major contributor to national GDP. According to Wise research, Filipino consumers collectively lost around US$170m (PHP₱9.74b) in 2024 due to hidden costs in cross-border money transfers.

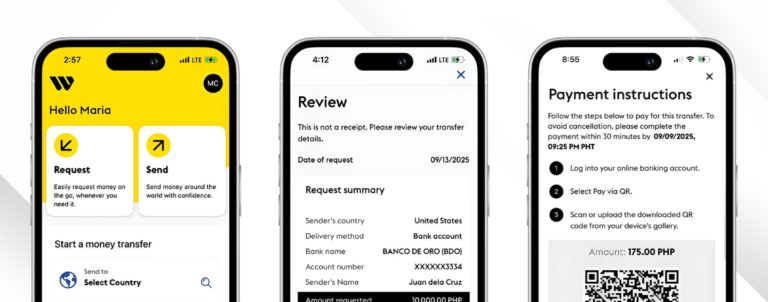

GoTyme Bank customers can now easily access and share their account details through the mobile app to receive international transfers securely.

The collaboration is designed to support Filipino households that rely on remittances for education, daily living, and business investments. By combining GoTyme Bank’s accessible digital banking services with Wise Platform’s global infrastructure, the partnership enhances the reliability, efficiency, and affordability of international payments.

As expectations grow for international transfers to be as simple and seamless as domestic payments, the partnership marks an important milestone in strengthening the country’s financial connectivity and supporting the Philippines’ broader digital and economic development.