Manila, Philippines – Philippine small and medium enterprises (SMEs) are set to streamline their payment processes and improve cash flow through a new integrated system introduced by BSP-regulated HitPay and global payments provider Ingenico.

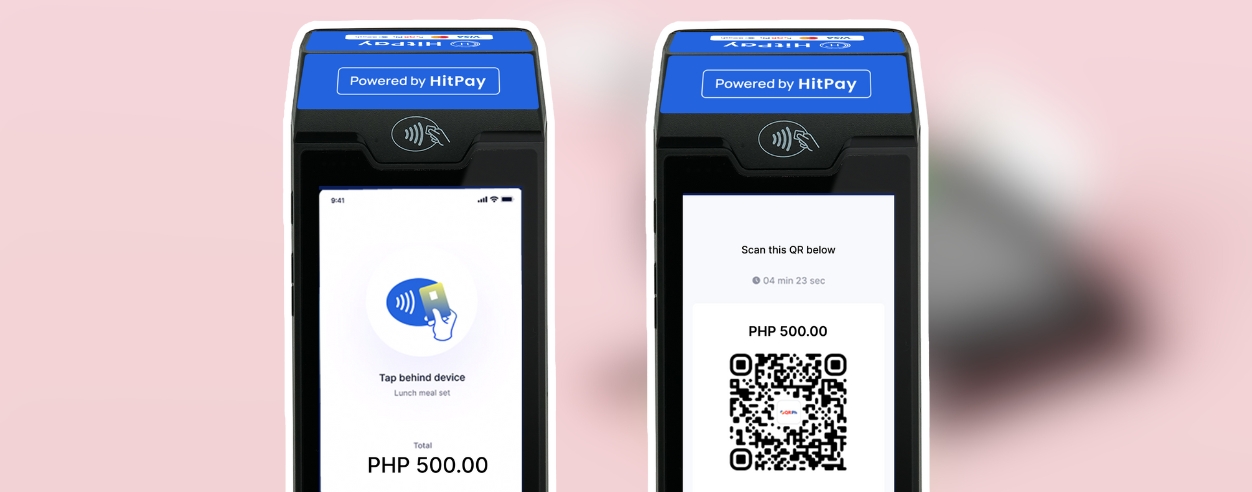

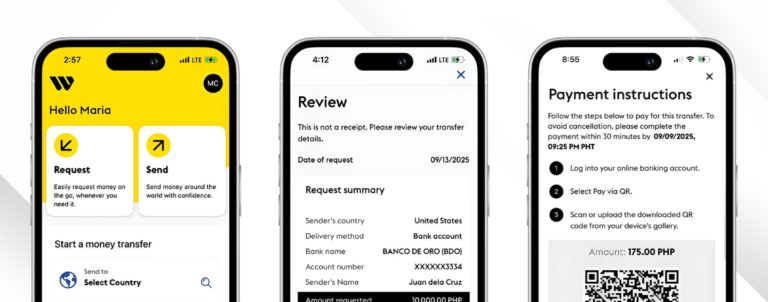

The solution allows merchants to accept a variety of payment methods, from credit and debit cards to QR-based e-wallets and cross-border transactions, from a single platform.

The system merges HitPay’s software with Ingenico’s smart terminal, helping SMEs manage payments more efficiently and access funds more quickly than with conventional models. It also supports unified online and offline payment processing, invoice issuance, recurring billing automation, and business insights to inform operational decisions.

Aditya Haripurkar, co-founder and CEO of HitPay, mentioned that this partnership is designed to support Philippine SMEs in implementing choice, speed, and secure payment solutions without being overwhelmed by complex software.

“Our collaboration with Ingenico goes beyond terminals and transactions; it is about democratising access to enterprise-grade tools, giving SMEs the ability to serve both domestic customers and tourists seamlessly,” Aditya commented.

By leveraging Ingenico’s global network alongside HitPay’s 25 regional payment partners, the partnership enables SMEs to serve both local customers and international visitors seamlessly. Initial deployments focus on retail, food and beverage, and travel sectors, with a target of reaching 10,000 SMEs in the Philippines over the next two years.

“Ingenico’s mission has always been to simplify payments for businesses of every size,” Xavier Michel, head of Southeast Asia channel markets at Ingenico, said.

“By working with HitPay, we are leveraging a comprehensive network of payment and banking partners giving Filipino SMEs access to secure and innovative tools, enabling growth and relevancy in a fast-changing market.”

HitPay, a BSP-regulated platform serving more than 20,000 small businesses across Southeast Asia, provides a no-code, full-stack solution supporting cards, QR codes, and over 700 wallets, with fast payouts and simple transaction-based pricing.

Ingenico operates in 32 countries and has deployed millions of payment devices globally, offering integrated solutions and partnerships to simplify payments and support business growth.