Thailand — Informatica, a global provider of enterprise AI-powered cloud data management, is collaborating with Krungsri (Bank of Ayudhya Public Company Limited) to strengthen the bank’s digital transformation and data-driven growth strategy.

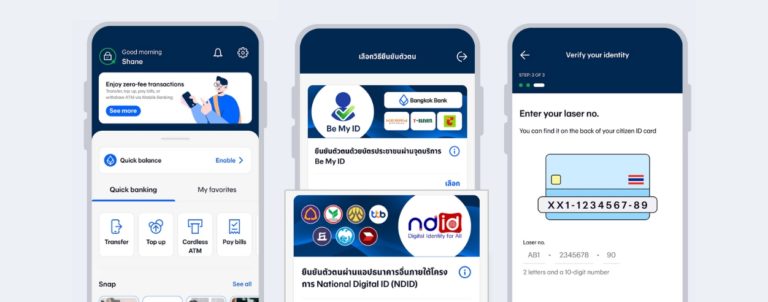

Krungsri is one of Thailand’s largest financial institutions and is advancing its goal of becoming a leading AI-driven digital bank. With a customer base that spans Thailand and more than 19 million customers throughout ASEAN, the bank requires a unified approach to managing data that has traditionally been siloed across business units.

A robust data governance framework is considered essential to ensure data quality, security, privacy and regulatory compliance.

Tul Roteseree, head of enterprise data and analytics group at Krungsri, explained how the bank adopts advanced data governance solutions in order to deliver enhanced data quality, accessibility, and integrity.

“With a scalable and robust governance framework for our cloud-enabled, secure technology infrastructure, we are helping ensure regulatory compliance and boost operational efficiency to drive customer-centric innovation and high-quality customer service,” Tul stated.

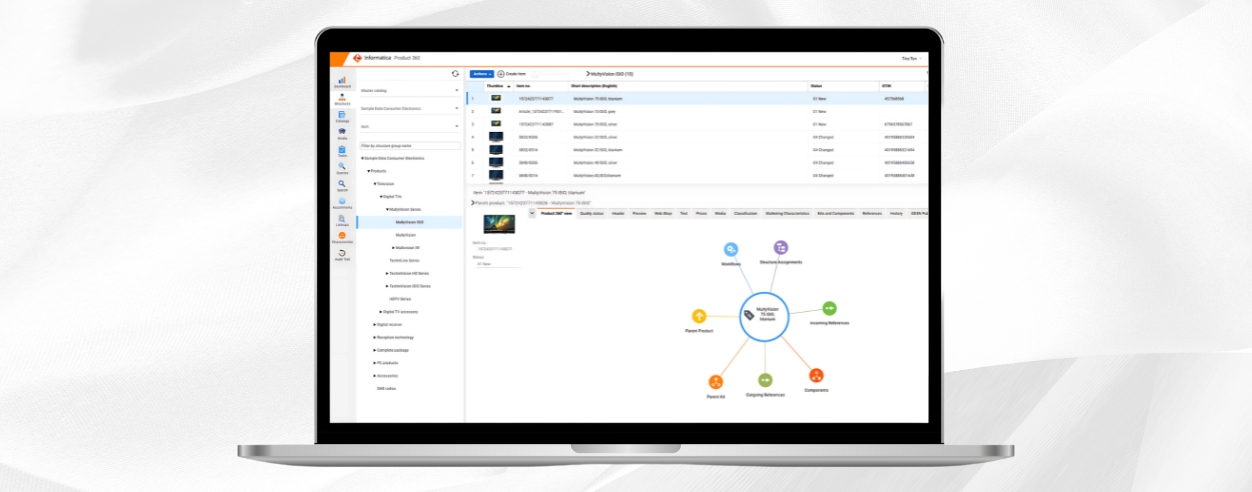

To support this, Krungsri is implementing Informatica’s Cloud Data Governance and Catalog (CDGC) and Cloud Data Quality (CDQ), built on Informatica’s AI-powered Intelligent Data Management Cloud™ platform.

“Krungsri’s transformation journey demonstrates how strategic data governance, enabled through our partnership, can help large financial institutions navigate data landscapes, accelerate innovation, and realise meaningful value,” Steven Seah, vice president for Informatica ASEAN, India, and Korea, said.

Since transitioning to a hybrid cloud environment with Amazon Web Services (AWS), the bank has prioritised solutions for data discovery, metadata management and data quality improvement. These tools are designed to strengthen data integrity, improve operational efficiency and build greater trust in business processes.

The collaboration reflects a growing trend among financial institutions in Thailand and across ASEAN to adopt advanced data governance capabilities, enabling greater innovation, improved compliance and enhanced customer experiences in an increasingly digital economy.