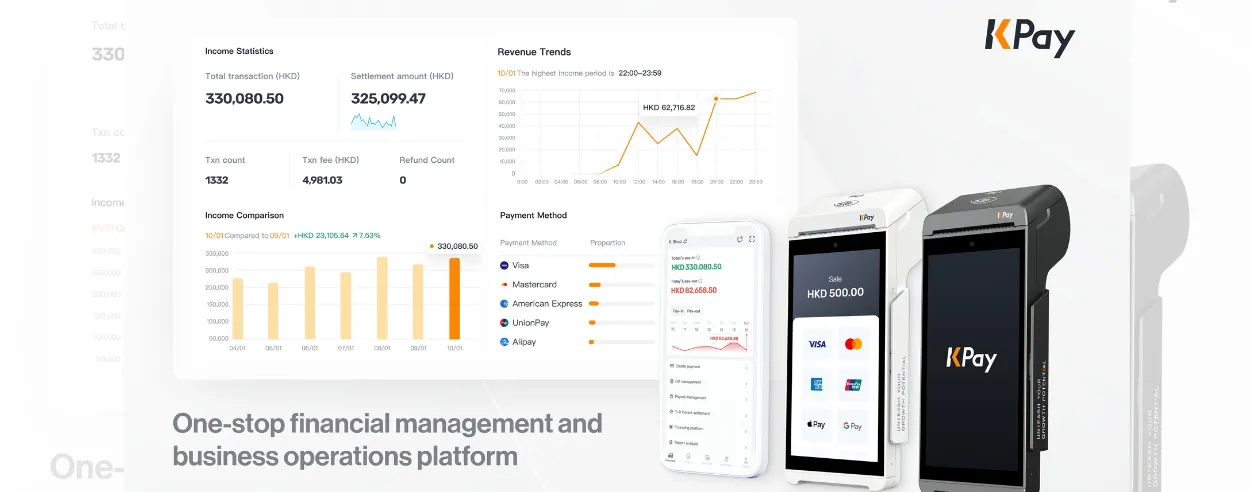

Singapore – KPay, a payment solutions firm, has recently announced that it has secured a total of US$55m in its first institutional funding round, marking the largest Series A in the global payments sector in 2024.

As part of the initiative, the firm revealed that the landmark investment was driven by Apis Growth Markets Fund III and Apis Global Growth Fund III, both managed by Apis Partners LLP. This affirms KPay’s strategic vision, market leadership, and bold growth ambitions.

This latest funding further allows the company to expand its presence across key Asian economies such as Indonesia, the Philippines, Malaysia, Thailand, and more. It is also set to leverage the capital to drive both organic growth and strategic mergers and acquisitions.

Furthermore, the new partnership complements both companies’ shared vision to drive meaningful change, recognising the critical role of SMEs, which account for 55.8% of total employment in Asia, and acknowledging that supporting SME growth fosters broader economic development and strengthens regional economies.

Davis Chan, co-founder and CEO at KPay, said, “I am incredibly proud of this financial milestone our team has achieved. We are excited to use this funding to not only expand our existing markets’ SME merchant base but also broaden our reach into new merchant industry categories, merchants of all sizes, and merchants operating in other underserved markets across Asia. This will bring us closer to our ambitious goal of supporting one million merchants over the next five years.”

Christopher Yu, President and CFO at KPay, also shared, “Securing this funding gives us financial strength and flexibility to enhance our product innovation, go-to-market speed, customer experience, and operational excellence. All of this is with our merchants in mind, in making it even simpler, smarter, and more cost-effective for them when using KPay’s services.”

“To do this, we need to continue to attract the best partners and global talent to join us, who share the same ambition to work alongside us to achieve the company’s vision and mission,” added Yu.

Meanwhile, Matteo Stefanel, co-founder and managing partner at Apis Partners, remarked, “We are thrilled to lead this investment in KPay, a unique company demonstrating remarkable growth under the leadership of seasoned third-time founders and an exemplary management team.”

“As one of the most active global fintech investors in growth-stage companies, Apis is eager to bring our domain expertise to support this exciting phase of KPay’s journey. With this combination of both financial strength and execution excellence, we look forward to a long-term partnership with KPay, to support their regional expansion, and spearheading next-gen financial management solutions in Asia’s diverse payments and software sector,” Stefanel said.

Meanwhile, Udayan Goyal, Co-Founder and Managing Partner at Apis Partners, further stated, “As a financial services-focused investor, we recognise the unique value KPay brings to the market through its commitment to empowering merchants with accessible, impactful financial tools.”

“This investment aligns perfectly with our ESG and Impact mandate to foster sustainable and inclusive growth within the financial sector, promoting the democratisation of finance, embedded finance, and the deepening of the digital economy. We look forward to supporting KPay as it scales, helping the company deliver meaningful financial solutions across Asia,” concluded Goyal.

The funding completion highlights investors’ confidence in companies like KPay, which have a well-established strategy for expanding across Asia while maintaining capital efficiency. Interestingly, KPay achieved this growth without raising venture capital prior to its Series A round.