Thailand — Bangkok Bank expanded its multi-year partnership with New Relic to strengthen monitoring of its mobile banking operations. The bank has used New Relic’s observability platform since 2020 to improve operational stability, drive mobile app growth, and deliver reliable digital services.

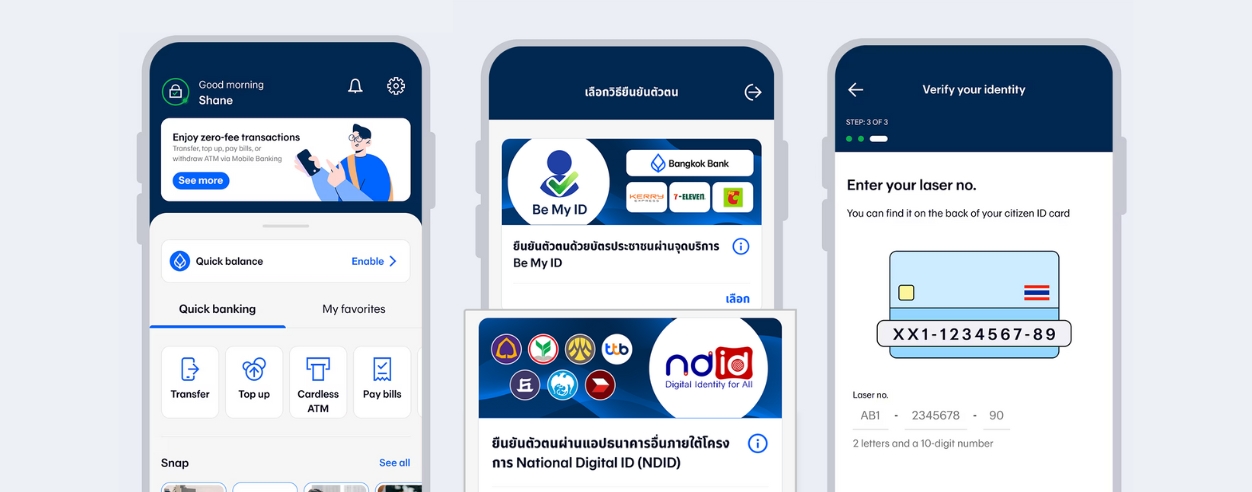

Under the new agreement, Bangkok Bank is extending its use of New Relic’s Digital Experience Monitoring (DEM) and Application Performance Monitoring (APM) tools.

These include mobile and browser monitoring, user journey analysis, crash reporting, custom dashboards, and infrastructure monitoring. By consolidating these capabilities on a single platform, the bank gains end-to-end visibility of its systems and operations.

The enhanced monitoring reduces downtime with AI-driven alerts that flag issues before they escalate, cutting recovery times significantly. Real-time dashboards give executives clear oversight of system health and business performance, while customer experience has improved through reduced failures and faster recovery.

Ian Guy Gillard, senior executive vice president at Bangkok Bank explained how there is a new climate of banking innovation as Thailand rapidly adopts digital systems and new government initiatives.

“Our mobile banking app isn’t just a tool; it’s a daily essential for millions. This means we see intense transaction spikes throughout the month,” Ian said.

“With increased visibility created by New Relic, we can cut through the complexity to proactively manage these peak periods and ensure a seamless digital customer experience.”

Bangkok Bank’s mobile platform processes instant transactions across 13 currencies without relying on third-party rails, which demands scalable infrastructure and continuous performance optimisation.

Arnie Lopez, chief customer officer at New Relic, stated how they support Bangkok Bank’s vision for digital modernisation and are proud to be their partner of choice.

“We take pride in their mission to deliver cutting-edge banking services while ensuring reliability and scalability. Together, we are setting new benchmarks for innovation in the Asian financial sector,” Arnie said.

Looking ahead, Bangkok Bank is testing New Relic’s broader AI capabilities to further automate issue detection and resolution. By adopting more advanced tools, the bank aims to strengthen its mobile-first strategy and reinforce its position as a leader in Thailand’s digital banking sector.