Singapore – Airwallex has closed a new Series G funding round worth US$330m, placing the company at an estimated value of US$8b, marking a notable rise of 30% since its previous Series F round earlier in the year.

The latest investment, backed by several global funds, is intended to accelerate the company’s expansion across the United States and other priority markets worldwide. A significant portion of the capital will support wider hiring and continued development of the firm’s financial technology capabilities.

As part of its long-term strategy, the company has designated San Francisco as a second global headquarters. This move reflects its intention to deepen its presence in the market, expand its physical footprint, and enhance access to specialised talent.

Airwallex has outlined plans to commit more than US$1b between 2026 and 2029 to reinforce its operations in the region, including the enlargement of its office space and a substantial increase in its workforce.

Jack Zhang, co-founder and CEO of Airwallex, mentioned that the company believes in the future of global banking with borderless, real-time, and intelligent technologies.

“Legacy providers are fundamentally incompatible with how modern businesses operate, and our investors understand that we’re pulling ahead in the race to define this category,” Jack commented.

He added, “We’re building a modern alternative, a single platform that powers global banking, payments, billing, treasury, and spend on top of proprietary financial infrastructure.”

The organisation, founded in Australia in 2015, already employs more than 2,000 people globally and expects to grow its headcount significantly over the next two years.

Airwallex continues to extend its regulated presence, having broadened its licensing and product availability across 12 new markets throughout 2025, including Korea, Japan, New Zealand, Malaysia, Vietnam, the Netherlands, and Canada. These developments form part of its ongoing investment in global financial infrastructure and partnerships.

“The traditional financial system wasn’t built for borderless businesses, and Airwallex is uniquely equipped to solve this challenge,” Lee Fixel, investor at Addition, explained.

“With its global financial infrastructure, software and AI capabilities, the company is exceptionally well positioned to lead the future of global business banking.”

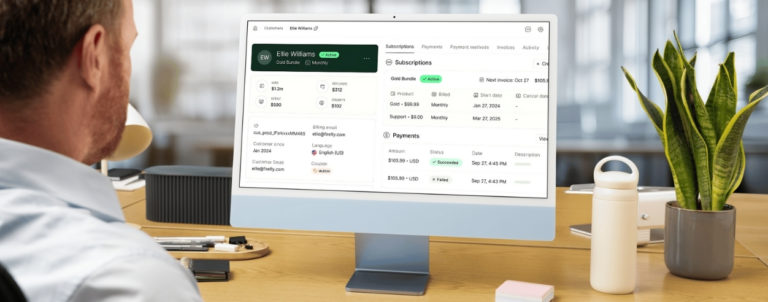

In addition to the expansion and funding, the company has introduced early elements of its autonomous finance strategy.

This includes the deployment of AI agents such as the Expense Submission Agent and the Expense Policy Agent, designed to streamline internal financial processes. While still at an early stage, these capabilities are intended to reduce manual tasks and support more efficient financial operations for customers.