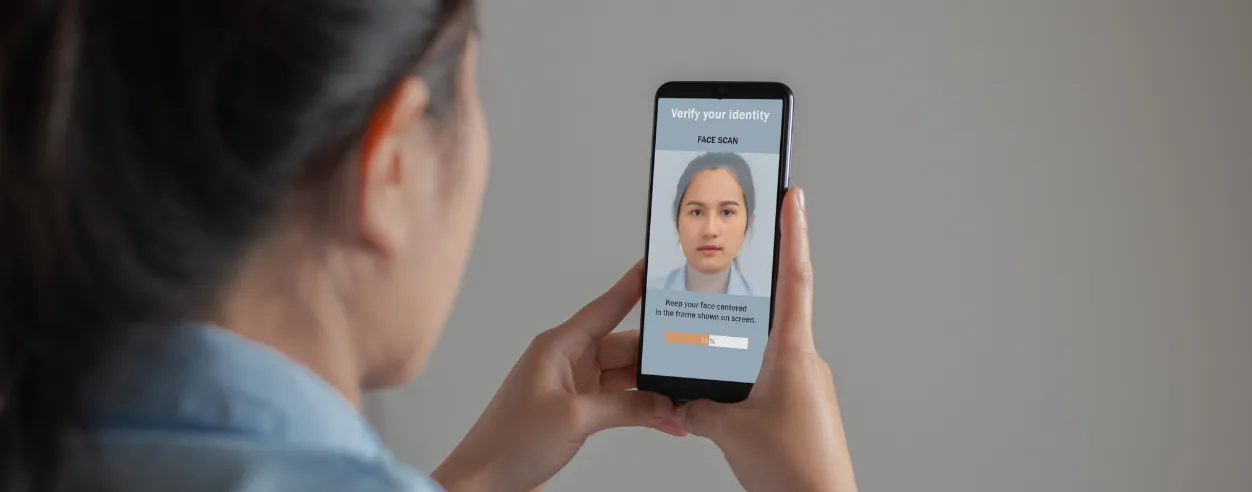

Singapore – A recent announcement from the Monetary Authority of Singapore and the Association of Banks in Singapore unveiled the country’s implementation of Singpass face verification among major retail banks.

This strategic approach will be rolled out in the next three months, with the goal of strengthening the digital token (DT) setup process for retail banking customers.

The latest initiative will be employed on higher-risk scenarios, complementing the existing authentication methods for digital token setup. SFV offers a face scan feature that verifies a customer’s identity against national records prior to its DT activation.

Said measure adds an extra layer of security, making it difficult for scammers to take over a customer’s digital token by setting it up on his own device using phished credentials like an SMS, one-time passwords (OTPs), and/or bank card information.

Customers who do not have a Singpass account may register for one and download the Singpass app before setting up their DT.

Banks in the country are now deploying this latest security measure, aiming to safeguard customers from scams.

Other measures and tools further encompass the gradual elimination of OTPs for bank account login by DT users and the Money Lock feature, where customers can “lock up” specified amounts of their funds that cannot be accessed digitally. These various measures will serve to step up our collective defence against scams.

Talking about the implementation, Ong-Ang Ai Boon, Director at ABS, shared, “Singpass Face Verification gives customers increased protection against unauthorised access to their bank accounts, adding to the suite of measures and tools that banks have provided customers to empower them to guard themselves against scams.”

“While banks will continue to do their part to fight scams, customers need to be vigilant themselves and practice good cyber hygiene,” added Ong-Ang.

Loo Siew Yee, assistant managing director (policy, payments, and financial crime) at MAS, further said, “The use of Singpass Face Verification will significantly strengthen the process of digital token setup. This is important as the digital token will be used as a factor to approve subsequent transactions.”

Loo also remarked, “MAS will continue to work closely with banks on measures to protect customers against scams. We urge consumers to maintain vigilance and avoid falling prey to scams by keeping updated on the latest scam tactics, practicing good cyber hygiene, and making use of Money Lock.”