In a world where nearly 1.7 billion people are unbanked globally, introducing full digitalisation of payment systems poses limited access to financial services. With traditional banking remaining central to the financial technology landscape, engaging in the digital economy is challenging for individuals, especially the unbanked.

DCBPays, a direct carrier billing platform by Forest Interactive, addresses this challenge by offering a simple and seamless payment solution. This move eliminates the need for traditional banking services and credit cards, making online purchases accessible to a larger population.

Leveraging the rising popularity and significance of direct carrier billing, it also caters to the simplicity, security, and financial inclusion facilitated by DCB, thereby contributing to ongoing advancements in technology. It specifically aims at the unbanked, those who are not reached by today’s banking technology.

As a platform adapting to the current technology, it also collaborates with up-to-date services or OTT content providers to broaden their access beyond the banked market.

Overcoming the challenges of financial exclusion

DCBPays plays a relevant role in resolving the issue by offering a solution that facilitates financial inclusion and shapes a more equitable digital financial landscape. It further helps to solve the payment limitation for the unbanked market when they try to enjoy premium contents or services, as there is potential revenue and demand from the unbanked market for premium contents.

Specifically, it introduces a range of notable features that enhance the field of financial technology, aligning seamlessly with the core principles of simplicity, security, and accessibility fostered by its direct carrier billing platform.

Its strengths lie in delivering a straightforward and smooth payment experience, bolstered by advanced security measures, streamlined online transactions, and universal accessibility.

Notably, the platform offers a secure one-click payment method, eliminating the need for users to input OTPs; instead, they can simply reply to a consent SMS to authorise the transaction. It also employs distributed encryption for “price” and “service” information that fortifies the platform against potential scams or fraudulent activities, safeguarding users’ phones and balances from exploitation.

As a new entrant to the direct carrier billing ecosystem, the company brings innovation, differentiation, and tailored solutions that enrich the DCB landscape. By expanding the market reach, addressing niche needs, and fostering healthy competition, they aspire to strengthen the ecosystem’s resilience and drive overall growth and evolution in digital payment.

DCBPays: How does it work?

To offer a comprehensive platform for managing Direct Carrier Billing (DCB), DCBPays integrates industry-leading APIs for swift market entry. It further leverages cutting-edge technologies such as AI to optimise performance and robust analytics for informed decision-making.

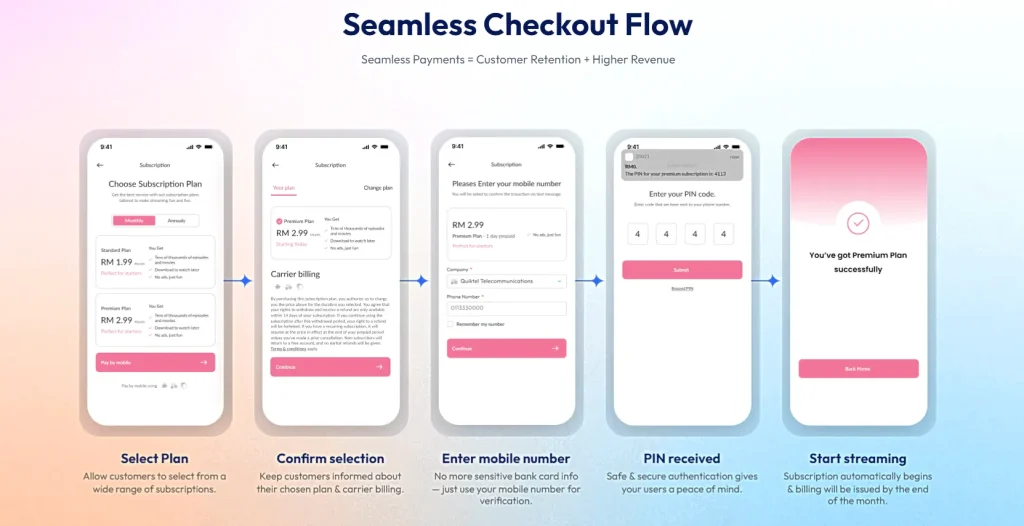

The platform focuses on delivering a seamless and user-friendly payment experience, harnessing the inherent simplicity, security, and financial inclusion enabled by DCB.

In particular, key technical elements include the following:

- Simplified user onboarding: Content and service owners can easily register and define their offerings, streamlining the onboarding process.

- One-click approval: Once service paperwork gains approval from the mobile operator, partners can promptly utilise DCBPays as a monetization channel, expediting the revenue generation process.

- Automated invoicing: Content and service partners can promptly invoice DCBPays upon the readiness of settlement reports, ensuring timely and efficient financial transactions.

- Self-service technical information and documentation guide: Technical teams of content and service partners can access essential API documentation, service flows, credentials, and other pertinent information directly from the client dashboard, eliminating the need for cumbersome email exchanges.

Understanding the platform’s commitment to enhancing both business and technical processes, the company focuses on security and convenience, which aim to smooth operations for both users and partners. At the same time, it also envisions aligning with its core principles of promoting financial inclusion while ensuring a secure and seamless payment ecosystem.

Shaping digitally-inclined financial transactions in the banking space

Looking into the future of technology, Yoseph Wijaya, head of product development and operation at Forest Interactive, outlined three important factors underlying the platform’s influence on the digital payment space, namely: (1) a simplified payment process; (2) increased accessibility; and (3) enhanced security measures.

- Simplified payment process: DCBPays streamlines the payment process by enabling users to purchase content or services and charge directly to their mobile phone credit. This simplicity reduces transaction complexity, resulting in a higher conversion rate for digital goods purchases.

- Increased accessibility: By broadening access to content and services, DCBPays reaches markets where traditional banking infrastructure is still underdeveloped. This expanded accessibility opens up new avenues for individuals to engage in digital transactions, driving further adoption and economic growth.

- Enhanced security measures: DCBPays incorporates robust security measures, continually enhanced by mobile operators. Features such as consent verification systems, secure app OTPs (one-time passwords), and clear customer service information instill confidence in users regarding the safety and reliability of direct carrier billing provided by mobile operators. This heightened security fosters trust and encourages more users to embrace digital payment solutions like DCBPays.

The platform’s influence, like similar digital payment platforms, is poised to be profound, shaping the way individuals transact and interact in an increasingly digital world.

Meanwhile, when asked about how the company’s vision contributed to shaping a transformative direction, Yoseph further emphasised the crucial role of leveraging technology to democratise access to financial services and foster positive societal impact.

He specifically noted the company’s commitment to prioritising innovation, customer-centricity, and inclusivity across all operations. Along with this, he also mentioned two major segments that make up the fundamental qualities of leading and championing their efforts: speed and quality.

“We strive for seamless integration with existing systems, complemented by comprehensive automated services such as service registration, subscription, charging, and refund processes, as well as detailed reports and invoices. These initiatives are aimed at expediting both the technical and business processes, reducing unnecessary time and barriers to market entry,” Yoseph explained.

On the other hand, in terms of quality, Yoseph further expounded, “Our focus on simplicity, security, and accessibility ensures that our platform caters to the diverse needs of our user base. By prioritising these aspects, we aim to increase the coverage of digital services and products, particularly for individuals without traditional banking access.”

“As we continue to innovate and evolve, we maintain our steadfast dedication to shaping a more inclusive and equitable digital financial landscape for all. Through ongoing efforts to enhance speed and quality, we remain committed to delivering solutions that empower individuals and promote financial inclusion on a global scale,” concluded Yoseph.